In today's fast-paced world, keeping tabs on your money can feel like a full-time job. Between managing subscriptions, tracking spending, and trying to save for the future, it’s easy for expenses to spiral out of control. This is where apps like Rocket Money step in, promising to simplify your financial life and help you save significant cash. But with so many budgeting tools available, a big question remains: is Rocket Money worth it for you?

We’re diving deep into everything Rocket Money offers, from its free features to its premium perks, to help you decide if this financial assistant deserves a spot on your phone.

What is Rocket Money, and How Does It Work?

Rocket Money, originally known as Truebill, was acquired by Rocket Companies in 2021 and rebranded in 2022. It's designed to be your personal financial hub, helping over 10 million members identify recurring charges, track spending, and automate savings. The app connects securely to your various financial accounts—checking, savings, credit cards, and investments—using Plaid, a trusted financial technology company. This connection gives Rocket Money a comprehensive view of your financial landscape, enabling it to provide personalized insights and suggestions.

At its core, Rocket Money works by bringing all your financial data into one place. Once linked, it automatically categorizes your transactions, flags recurring bills, and provides a clear picture of where your money is going. While the app is free to download and use for its essential features, it also offers a premium tier for those seeking more advanced tools.

Unpacking Rocket Money's Core Features and Benefits

Rocket Money's appeal lies in its diverse set of tools, some of which are free, while others require a premium membership. Its most celebrated function is undoubtedly subscription management, but that's just the tip of the iceberg. You can get a full breakdown of what it offers when you check out our guide on Rocket Money Features & Benefits.

Here’s a snapshot of what you can expect:

Smart Subscription & Bill Management

Perhaps Rocket Money's biggest claim to fame is its ability to identify and help you cancel unwanted subscriptions. The app scans your linked accounts, pulls up all recurring charges, and presents them in a clear, actionable list. For free users, it provides detailed instructions (like phone numbers or online guides) to cancel services yourself. Premium users get the added benefit of the "Subscription Cancellation Assistant," where Rocket Money's team will contact the company on your behalf. This feature alone has saved users a considerable amount of money by uncovering forgotten memberships.

Detailed Spending Tracking & Budgeting

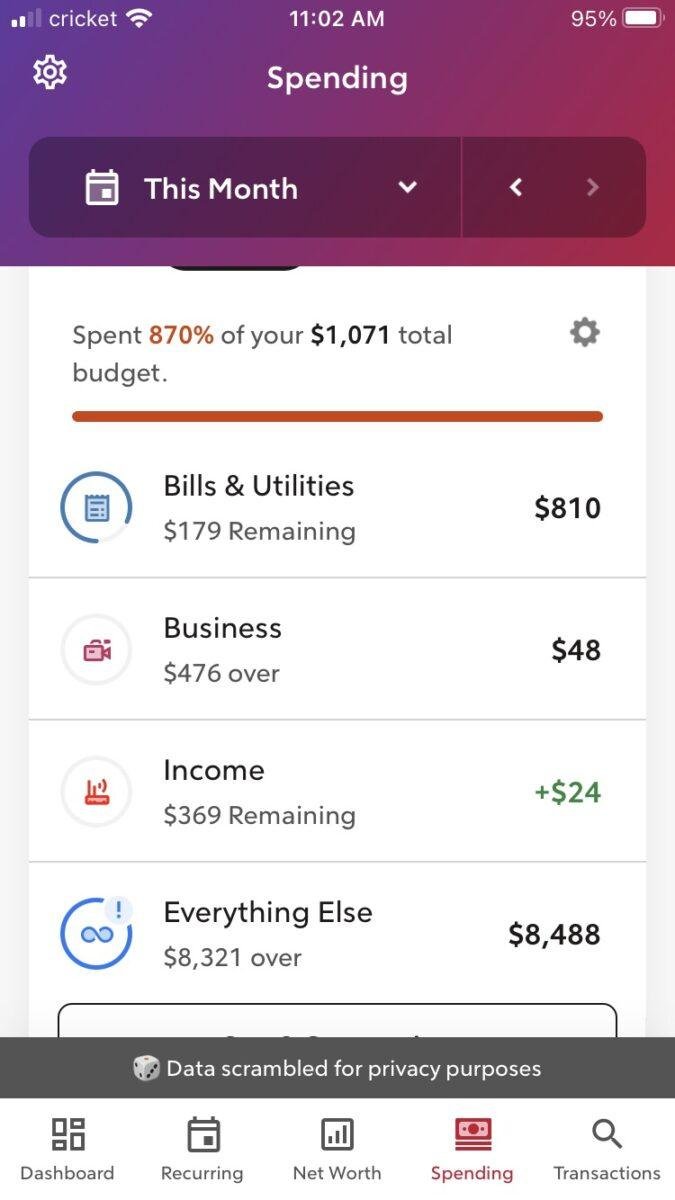

Understanding your spending habits is the first step to financial control. Rocket Money’s "Spending" tab offers a clear overview of your income and expenses, categorizing where your money goes. You can view your spending by week, month, quarter, or year, helping you spot trends and identify areas for improvement. Free users can set up one budget with a couple of custom categories, offering a good starting point for basic budgeting. The app even helps you set realistic goals by showing your past spending and average earnings.

Beyond the Basics: Premium Features

For those ready to dive deeper, Rocket Money's premium tier unlocks a suite of powerful features designed for more sophisticated financial management. This includes unlimited custom budget categories, multiple budgets, personalized dashboards, and the ability to tag transactions and create custom rules for categorization.

Premium users also gain access to:

- Bill Negotiation: Rocket Money specialists attempt to negotiate lower rates for services like internet, cable, and cell phone bills. However, be aware that this service comes with a fee—a percentage of your first year's savings.

- Automated Savings: Set financial goals (e.g., debt payoff, down payment), and Rocket Money will analyze your finances to determine a realistic savings amount, then automatically transfer funds to an FDIC-insured savings account within the app.

- Net Worth Tracking: Consolidates all your linked assets and debts to give you a real-time view of your overall financial health.

- Credit Report Monitoring: Provides access to your current credit score, report, and history, helping you keep an eye on your credit health.

Essential Free Tools for Everyone

Even without a premium subscription, Rocket Money provides valuable features that can make a real difference. Beyond basic budgeting and subscription management, free users can set up balance alerts to notify them when an account balance dips below or rises above a certain threshold. This is a simple yet effective tool for preventing overdrafts and overspending.

Understanding Rocket Money's Security & How Your Data is Handled

One of the first questions people have when linking their bank accounts to an app is about security. Rocket Money uses Plaid, an industry-standard financial technology company, to securely connect to your bank accounts. Plaid employs bank-level encryption and security protocols to protect your information. When you link an account, Plaid shares certain details with Rocket Money, including your account balances, transaction history (up to 12 months), and sometimes even tax documents (up to 24 months, with limited SSN/TIN details).

It's important to know that you can revoke sharing access at any time directly through the Rocket Money app. While no system is 100% impervious, Rocket Money and Plaid utilize robust security measures to safeguard your financial data, aiming to give you peace of mind. For a deeper dive into how your information is protected, consult our guide on Rocket Money Security & Data.

Is the Premium Worth It? Exploring Rocket Money's Pricing

Rocket Money offers a unique, flexible pricing model for its premium features. Instead of a fixed price, users choose what they want to pay, ranging from $6 to $12 per month, with a 7-day free trial. This "choose your own price" approach can be appealing, but it still begs the question: is it worth paying anything for Rocket Money, especially when some core functionalities are free?

The value of the premium subscription largely depends on your specific financial needs and how actively you intend to use the advanced features. If you're a heavy user who benefits from unlimited budgets, custom categories, and automated savings, the monthly fee might justify itself in the time and money saved. However, if you primarily need subscription cancellation and basic spending tracking, the free version might suffice. To truly weigh the cost against the benefits, you'll want to Explore Rocket Money pricing plans in detail.

Use Rocket Money Effectively: Get the Most Out of Your Download

To truly maximize your experience with Rocket Money and get your money's worth (whether free or premium), a little proactive effort goes a long way. Here are some actionable recommendations:

- Link All Accounts & Review Regularly: The more accounts you link, the more accurate Rocket Money's financial picture will be. Make it a habit to regularly review transactions for correct categorization and to spot any unauthorized charges.

- Craft a Realistic Budget: Use the app's historical data on your income and spending to create a budget that's achievable. Consider adding a small buffer (around 5%) for recurring expenses to avoid feeling constrained.

- Actively Hunt Down & Cancel Unused Subscriptions: This is Rocket Money’s superstar feature. Even free users can easily find cancellation instructions. Make it a monthly task to review your "Recurring" tab and axe anything you no longer use.

- Leverage Balance Alerts: These free notifications are incredibly useful for preventing overdraft fees and making sure you don't overspend on your credit cards. Set them up for all relevant accounts.

- Strategic Savings: While Rocket Money's automated savings feature can help you determine how much you can save, its internal savings accounts don't earn interest. We recommend using the app for planning, then manually transferring those determined amounts to a high-yield savings account elsewhere to make your money work harder for you.

- Reconsider Bill Negotiation: Many users report mixed results and frustration with Rocket Money's bill negotiation service, which charges a hefty 35%-60% of the first year's savings. You can often achieve the same or better results by contacting your service providers directly and negotiating yourself, saving that percentage fee.

- Go Premium for Advanced Control: If you decide to pay, maximize value by utilizing multiple budgets, custom categories, transaction tags, and rules for automated categorization. This transforms Rocket Money into a powerful, personalized financial management tool.

By following these tips, you'll Use Rocket Money effectively Get the most out of its capabilities.

Rocket Money in Comparison: Are There Better Alternatives?

While Rocket Money excels at its flagship subscription management, its overall budgeting experience might not be for everyone. For daily budgeting and a more granular approach to tracking spending, other apps often come up in comparison.

- For dedicated budgeting: Apps like Monarch Money, PocketGuard, and YNAB (You Need A Budget) are frequently cited for their robust budgeting features, offering more intuitive interfaces or specific methodologies (like YNAB's zero-based budgeting).

- For couples: Honeydue is a recommended free alternative specifically designed for budgeting with a partner.

- Unique offerings: Rocket Money does stand out by including a free credit score, retirement planner, and investment tracking capabilities, which some competitors might lack or offer only in premium tiers.

Ultimately, the "best" app depends on your individual needs. If subscription cancellation is your top priority, Rocket Money is a strong contender. If detailed, highly customizable budgeting is your main goal, it’s worth looking at alternatives. Dive deeper into how Rocket Money stacks up against its competitors by exploring our guide on Explore Rocket Money alternatives.

The Pros and Cons: A Quick Look

To help summarize, here's a balanced view of Rocket Money's strengths and weaknesses:

Pros:

- Effective Subscription Management: Excellent at identifying and helping you cancel unused subscriptions, saving users real money.

- Free Core Features: Provides valuable basic budgeting, balance alerts, and subscription identification at no cost.

- Quick Account Linking: Easy and secure connection to multiple bank accounts via Plaid.

- Realistic Budgeting: Uses past spending data to help set achievable financial goals.

- Flexible Premium Pricing: Allows users to choose their monthly payment amount within a range.

- Comprehensive Overview: Consolidates various financial data points in one place.

Cons: - Premium for Advanced Features: Many desirable tools (like unlimited budgets, automated savings, bill negotiation) require a paid subscription.

- Time-Consuming Setup: Getting an accurate budget and categorizing transactions initially can take effort.

- Bill Negotiation Issues: Frequent customer complaints regarding the effectiveness and high fees (35%-60% of first-year savings) of this service.

- Non-Interest-Earning Savings: Automated savings are held in a Rocket Money account that doesn't earn interest, making it less ideal for long-term growth.

- Promotes Hands-Off Approach (Potentially): Some critics argue it can encourage users to be less engaged with their finances by automating tasks they could do independently.

So, Is Rocket Money Worth It?

The answer, as with most financial tools, isn't a simple yes or no; it depends on your needs and how you use it.

- Rocket Money is definitely worth it for free users who want an easy way to track subscriptions, get basic spending insights, and set balance alerts to avoid overdrafts. The ability to quickly identify and cancel forgotten memberships can literally pay for itself many times over.

- Rocket Money can be worth it for premium users who are committed to using its advanced features like unlimited custom budgets, automated savings planning (remember to transfer to high-yield accounts!), and comprehensive net worth tracking. If you value the convenience of having everything in one app and are willing to pay for that level of integration, the premium tier offers significant value.

However, if your primary goal is a highly detailed, zero-based budgeting system, or if you're uncomfortable with the bill negotiation fees, you might find other apps a better fit.

Ultimately, Rocket Money provides a powerful set of tools to help you take control of your finances. Whether you choose the free version or opt for premium, the potential for savings and better financial awareness is clear. The key is to engage with the app, link your accounts, and actively use its features to make your money work smarter for you. Your financial journey is unique, and with the right tools and commitment, you can achieve your goals.