For many, the idea of taming financial chaos feels like launching a rocket without a clear flight plan. Enter Rocket Money, an app promising to simplify the journey to financial control by leveraging a suite of powerful Rocket Money features and benefits. But what exactly does this digital co-pilot offer, and how effective is it at steering your finances towards a brighter future?

This guide dives deep into Rocket Money's capabilities, from its free core tools to its premium, concierge-level services. We'll cut through the marketing jargon, examine the real-world utility, and help you determine if Rocket Money is the right launchpad for your financial ambitions.

At a Glance: What Rocket Money Offers

- Consolidated View: Links all your financial accounts for a complete picture.

- Subscription Tracker: Identifies and monitors all your recurring bills.

- Spending Insights: Breaks down where your money goes.

- Balance Alerts: Notifies you of low balances or high spending.

- Net Worth & Credit Score: Tracks your total financial health and credit standing.

- Basic Budgeting: Helps categorize and monitor spending.

- Premium Perks: Includes bill negotiation, automated subscription cancellation, enhanced budgeting, and human chat support.

- Pricing: Free for basic features; $6–12/month for Premium (with a 7-day trial and "pay what you think is fair" model). Bill negotiation incurs an additional fee (35–60% of annual savings).

- Security: Uses Plaid for account linking; smart savings are FDIC-insured.

Rocket Money: Your Financial Co-Pilot (A Quick Overview)

Launched in 2015 by the financial giants at Rocket Companies (you might know them from Rocket Mortgage), Rocket Money aims to put you firmly in the driver's seat of your money. It significantly expanded its reach and capabilities after acquiring Truebill in 2021, officially rebranding in August 2022. The company boldly claims to have saved its members over $2.5 billion – a testament to its mission to help you save more, spend less, see everything, and truly take command of your financial life.

This app is designed for anyone feeling overwhelmed by multiple accounts, forgotten subscriptions, or simply wanting a clearer understanding of their cash flow. It aggregates your financial data into a single dashboard, providing clarity that can be surprisingly hard to achieve otherwise.

Unpacking Rocket Money's Core Features (The Free Tier)

Even without subscribing to a premium plan, Rocket Money provides a robust set of tools designed to bring order to your financial world. Think of these as the essential instruments on your financial dashboard.

See Everything in One Place: Account Linking

At its heart, Rocket Money is an aggregator. By linking your checking, savings, credit cards, and even investment accounts, the app provides a unified view of your entire financial landscape. No more jumping between bank apps or spreadsheets; it's all right there, giving you an immediate and comprehensive understanding of your money. This single dashboard approach is incredibly valuable for spotting trends and identifying financial blind spots.

Hunting Down Hidden Costs: Subscription Management

This is often where Rocket Money truly shines for many users. The app scours your linked accounts to identify all recurring subscriptions and bills. From streaming services you forgot you signed up for to that gym membership you never use, Rocket Money lays them all bare. This feature alone can be an eye-opener, revealing expenses you might easily cut to boost your savings.

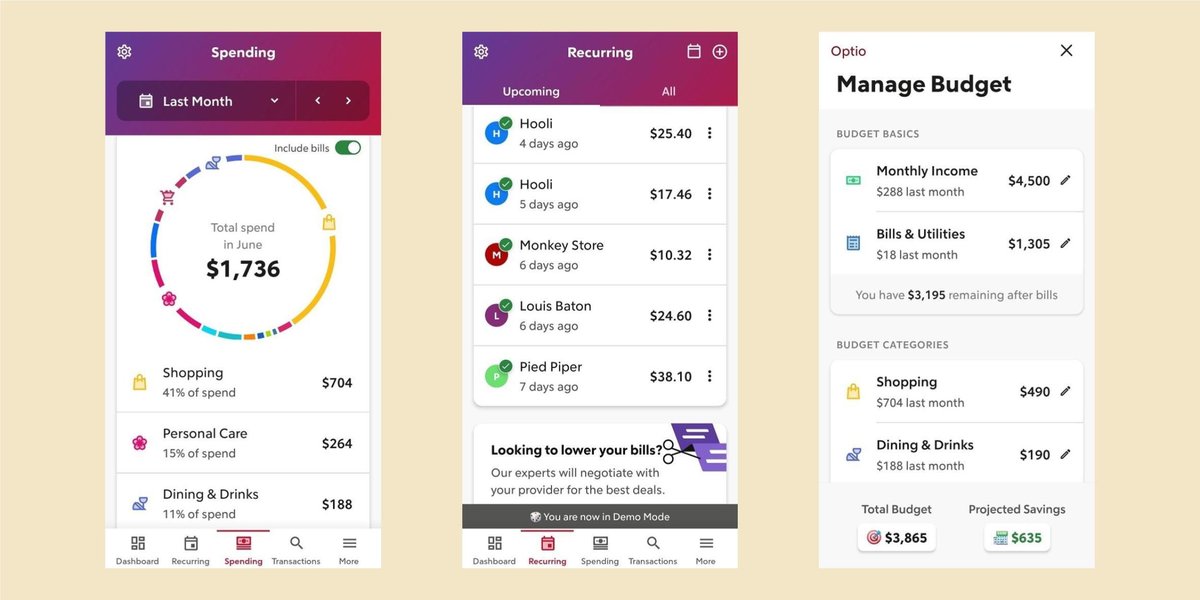

Where Does It All Go? Spending Tracking

Understanding your spending habits is the first step toward changing them. Rocket Money breaks down your finances, categorizing transactions to show you exactly where your money is flowing. Are you spending too much on dining out? Are your entertainment costs getting out of hand? The app helps you identify spending trends over time, providing the data needed to make informed adjustments. It also notifies you of important financial events, ensuring you stay in the loop.

Avoiding Financial Potholes: Balance Alerts

Overdraft fees can be a costly and frustrating experience. Rocket Money aims to help you avoid these pitfalls by sending alerts when your checking account balance dips below a safe threshold. It can also notify you if your credit card spending is unusually high, prompting you to pause and assess before you overspend. These timely nudges can save you real money and prevent unnecessary stress.

Your Complete Financial Snapshot: Net Worth Tracking

Want to know your financial standing at any given moment? Rocket Money calculates your total net worth by aggregating all your assets (what you own) and debts (what you owe). Watching your net worth grow can be a powerful motivator for making smart financial choices, giving you a tangible measure of your progress toward long-term goals.

Keeping an Eye on Your Credit: Credit Score Tracking

Your credit score is a crucial indicator of your financial health, impacting everything from loan approvals to interest rates. Rocket Money provides access to your current credit score, a complete credit report, and your credit history. It also sends alerts for any significant changes, helping you stay vigilant against fraud and proactively manage your credit profile.

Laying the Groundwork: Basic Budgeting

While the free version of Rocket Money's budgeting tools are less robust than its premium counterpart (or dedicated budgeting apps), they still offer a starting point. You can set up a basic budget to monitor spending by category, giving you an initial framework for managing your money. It's a foundational step towards more disciplined financial habits.

Stepping Up Your Game: Rocket Money Premium Features

For those seeking a more hands-on, concierge-style approach to their finances, Rocket Money offers a premium subscription. This tier unlocks advanced capabilities, turning the app from a mere tracker into an active assistant.

Effortless Cuts: Subscription Cancellation Assistant

Found unwanted subscriptions using the free tracker? With a Premium subscription, Rocket Money takes the hassle out of canceling them. Instead of navigating confusing websites or enduring lengthy phone calls, you simply tell Rocket Money which subscriptions to ditch, and their team handles the cancellation process on your behalf. It’s a significant time-saver, particularly for those notoriously difficult-to-cancel services.

Lowering Your Bills: Bill Negotiation Concierge

This is arguably one of Rocket Money's most talked-about Premium features. The service identifies bills that can potentially be lowered—think internet, cable, or cell phone bills—and then negotiates with the providers for you. Their team works to secure better rates, discounts, or even credits, aiming to reduce your recurring expenses. This can feel like having a personal advocate for your wallet.

Savings on Autopilot: Automated Savings Plan

Many people struggle with consistent saving. Rocket Money's Automated Savings Plan aims to solve this by learning your spending habits and automatically transferring small amounts of money into a dedicated savings account at opportune times. The idea is to save money for you without you feeling the pinch, always aiming to avoid overdrafting your primary accounts. This "set it and forget it" approach can be effective for building an emergency fund or reaching specific financial goals gradually.

Tailored Control: Enhanced Budgeting

If the free budgeting features felt too basic, Premium steps up the game. You gain access to custom categories and the ability to create unlimited budgets. This allows for a much more granular and personalized approach to tracking and controlling your spending, fitting your unique financial lifestyle rather than a one-size-fits-all model.

Managing Together: Shared Accounts

For couples, families, or anyone managing finances with another person, the shared accounts feature allows you to link and monitor joint financial activities within the app. This fosters transparency and makes collaborative financial management simpler, ensuring everyone is on the same page regarding shared expenses and goals.

Direct Line to Help: Chat Support

Premium members get access to human assistance through chat support. This means you can directly communicate with a Rocket Money representative for financial questions, assistance with subscription cancellations, or updates on your bill negotiation progress. It adds a layer of personalized service, providing peace of mind that help is just a message away.

The Cost of Convenience: Understanding Rocket Money's Pricing

Rocket Money operates on a freemium model, offering a tiered approach to its features.

- Free Basic Features: You can download the app and use the core account linking, subscription tracking, spending insights, and basic budgeting features without paying a dime. This is a great way to test the waters and see if the app's interface and core functionality suit your needs.

- Premium Subscription: To unlock the full suite of advanced features, including automated cancellations, bill negotiation, and enhanced budgeting, you'll need a Premium subscription. The pricing for Premium is unique, using a "pay what you think is fair" scale, typically ranging from $6 to $12 per month. You can try Premium with a 7-day free trial.

- The Bill Negotiation Fee: This is where many users encounter an additional cost. Even with a Premium subscription, Rocket Money's bill negotiation service incurs an additional upfront fee ranging from 35% to 60% of the annual savings achieved. For example, if Rocket Money negotiates a $175 annual saving on your internet bill, their fee could be anywhere from $61 to $105. This fee is paid to Rocket Money for their service in securing the discount.

- Alternative Premium Access: You can also gain Premium access by applying for and using a Rocket Visa Signature Card, effectively bundling the app's premium features with a credit card product.

Your Money's Fort Knox: Rocket Money's Security Measures

When you're linking all your financial accounts, security is naturally a top concern. Rocket Money prioritizes the safety of your data:

- Plaid Integration: Rocket Money does not store your actual login information for your financial accounts. Instead, it links your accounts using Plaid, a widely trusted financial technology company that acts as a secure intermediary between your bank and third-party apps. Plaid uses advanced encryption and security protocols to protect your data.

- FDIC-Insured Savings: If you utilize Rocket Money's Smart Savings accounts, rest assured that these accounts are held in FDIC-insured U.S. bank accounts. This means your savings are protected by the Federal Deposit Insurance Corporation up to the maximum legal limit ($250,000 per depositor, per insured bank, for each account ownership category), even if the holding bank were to fail.

Beyond the Hype: Critical Look at Rocket Money's Value and Limitations

While Rocket Money offers compelling features, it's crucial to approach any financial tool with a balanced perspective. Here's a look at some common critiques and considerations:

The "Autopilot" Paradox: Hands-Off vs. True Control

Rocket Money's appeal often lies in its automation and "set it and forget it" approach, particularly with its automated savings plan. However, some critics argue that relying too heavily on automated money management can prevent users from developing genuine financial literacy and proactive control. True financial mastery often comes from actively engaging with your money, understanding every dollar, and making conscious decisions, rather than delegating it all to an app.

Subscription Cancellation: What's the Real Benefit?

While the convenience of having Rocket Money cancel subscriptions for you is undeniable, many of the subscriptions they handle are relatively easy to cancel yourself for free. For very complex or persistent cancellations, their service can be a lifesaver. But for simpler ones, you might be paying a premium for a task you could accomplish with a few clicks.

Is the Bill Negotiation Fee Worth It?

The bill negotiation service is powerful, but its fee—35-60% of annual savings—is a frequent point of contention. While Rocket Money does the heavy lifting, many users could achieve the same savings by simply calling their providers and negotiating themselves. If you're willing to invest a little time, you could keep 100% of those savings. It's also worth noting that negotiated savings may only apply to the first year, meaning the benefit could diminish over time without re-negotiation. To truly Discover if Rocket Money is worth it for you, consider your willingness to engage in these negotiations yourself.

Budgeting: Free Limitations and Auto-Categorization Issues

The free version of Rocket Money's budgeting is quite basic. For serious budgeters, the limited features can feel restrictive. Furthermore, while the app auto-categorizes transactions, it's not always perfect. Misplaced transactions can skew your budget and require manual correction, undermining the "autopilot" promise and potentially leading to inaccurate spending insights. Critics suggest the app focuses more on monitoring past spending than empowering proactive budget creation and adherence.

Value Proposition: Are These Features Truly Unique?

Many of the core features offered, even in the free version—like account linking, net worth calculation, and credit score checks—are readily available through other free apps, banks, or can be done manually with a little effort. The true value often comes down to the convenience of having them all in one place and the premium concierge services.

Customer Concerns: Billing and Cancellation Difficulties

A recurring theme in customer complaints revolves around unexpected charges for bill negotiation services (sometimes appearing when users didn't fully understand the fee structure) and difficulties canceling Rocket Money accounts, leading to continued charges. These experiences highlight the importance of thoroughly understanding the terms and conditions before subscribing to Premium or opting into negotiation services.

Debt Products: A Potential Slippery Slope

Rocket Money, as part of Rocket Companies, naturally focuses on financial products. Some observers note that the app's emphasis on credit score tracking and its affiliations with related debt products could subtly encourage users to focus on credit and potentially engage with debt, rather than solely promoting debt reduction or cash-based budgeting.

Considering Your Options: When Rocket Money Might (or Might Not) Be For You

Rocket Money is a powerful tool, but like any solution, it fits some needs better than others.

Rocket Money might be for you if:

- You're overwhelmed by scattered accounts: The unified dashboard is a huge relief.

- You suspect you have forgotten subscriptions: This feature is excellent for uncovering hidden drains on your wallet.

- You want a clear picture of your spending: The spending tracker and categorization can provide valuable insights.

- You struggle with consistent saving: The automated savings feature could be a game-changer for building reserves.

- You dislike negotiating bills: If the idea of calling customer service fills you with dread, the negotiation service might be worth the fee.

- You prioritize convenience above all else: The app aims to simplify and automate many financial tasks.

You might want to explore alternatives if: - You're a proactive, hands-on budgeter: If you thrive on detailed, zero-based budgeting and custom categorization from the get-go, a dedicated budgeting app like EveryDollar might offer more granular control and a stronger emphasis on forward-looking financial planning.

- You're unwilling to pay high fees for bill negotiation: If you have the time and confidence, you can negotiate your own bills and keep 100% of the savings.

- You're concerned about a "hands-off" approach to money: If you believe true financial control comes from active engagement, Rocket Money's automation might feel too detached.

- You already use other free tools: Many of Rocket Money's basic features are available elsewhere without needing another app.

- You're wary of potential unexpected charges or cancellation difficulties: While not universal, these customer complaints are worth considering.

Taking Charge: Your Next Steps to Financial Control

Understanding the Rocket Money features and benefits is just the beginning. The real power comes from making an informed decision about how to integrate such a tool into your personal financial strategy.

Start by considering your biggest financial pain points. Is it tracking subscriptions, understanding spending, or simply seeing your entire financial picture? The free version of Rocket Money offers substantial value for these core needs, making it a low-risk way to explore its capabilities.

If you find yourself consistently forgetting to save, dreading phone calls to negotiate bills, or wanting a more streamlined approach to account management, then the premium features might justify the cost. However, always be clear on the fee structure, especially for bill negotiation, and understand the trade-offs between convenience and potential savings.

Ultimately, Rocket Money provides a suite of tools designed to demystify your money and empower you to make smarter choices. Whether you use it as a simple tracker or a full-fledged financial co-pilot, the goal remains the same: to achieve greater control and confidence in your financial journey.