The quest for financial clarity often leads us down a rabbit hole of apps promising to simplify our money lives. Among them, Rocket Money stands out, offering a suite of tools designed to put you back in the driver's seat. But beyond the slick marketing, what are the User Reviews & Real-World Experiences with Rocket Money actually telling us? Does it deliver on its promises to automate savings, slash bills, and bring order to your financial chaos?

We've sifted through countless firsthand accounts, dug into the app's mechanics, and pulled together the definitive guide to what real people encounter when they trust Rocket Money with their finances.

At a Glance: What Users Are Saying About Rocket Money

- Strong on Subscription Cancellation: A consistent favorite, users love how Rocket Money identifies and helps them cancel unwanted recurring payments, often saving significant money.

- Effective Bill Negotiation (When It Works): Many report successful bill reductions, particularly with major service providers, appreciating the "no win, no fee" model. However, success isn't guaranteed for everyone.

- Intuitive Interface & Excellent Transaction Management: The app is widely praised for its clean design, ease of use, and robust tools for tracking and categorizing spending.

- Valuable Budgeting Tools: Both automatic suggestions and custom budget creation receive positive feedback for helping users understand and control their spending.

- "Pay-What-You-Wish" Premium Can Be Confusing: While flexible, the suggested Premium pricing structure sometimes leaves users wondering about the 'right' amount to pay for advanced features.

- Underwhelming Investment Management: If you're looking for sophisticated investment tracking or advice, Rocket Money isn't the primary solution, and users often note this gap.

- Secure & Trustworthy: Users generally feel confident in the app's security measures, including bank-level encryption and multi-factor authentication.

Beyond the Marketing Hype: What Rocket Money Is (and Isn't)

Before diving into the nitty-gritty of user experiences, let's quickly frame what Rocket Money brings to the table. At its core, it's a personal finance app aimed at automating savings, enhancing budgeting, monitoring credit scores, and keeping tabs on all your financial accounts and transactions in one place. It specifically tackles debt management through its renowned features for identifying and canceling subscriptions, plus its proactive approach to negotiating certain bills on your behalf.

While it boasts a top-notch user experience and robust transaction management, it's not an investment powerhouse. If your primary need is complex portfolio analysis, you might find its investment management capabilities rather underwhelming. Moreover, while its Premium tier offers a "pay-what-you-wish" model, the suggested amounts ($6-$12 per month) and the requirement for credit card details for a 7-day trial sometimes spark questions about straightforwardness. But before we get deeper into those specifics, you might be asking yourself Is Rocket Money truly worth it? for your specific financial situation.

The app connects securely to your online financial accounts using Plaid, a widely trusted financial technology platform, ensuring your data is handled with care.

The User Experience: Navigating Rocket Money Day-to-Day

One of the most consistently positive aspects highlighted in user reviews is Rocket Money's interface. It’s not just aesthetically pleasing; it’s genuinely intuitive.

Intuitive Interface & Dashboards: Seeing Your Money Clearly

Users frequently commend the app's clean and uncluttered design. The main dashboard acts as a command center, displaying key financial data at a glance—balances across accounts, recent transactions, and spending summaries. This visual clarity is crucial for anyone feeling overwhelmed by disparate bank accounts and credit cards.

Mobile app users also benefit from additional features like quick access to credit scores and "Smart Recommendations." These aren't just generic tips; they’re tailored suggestions designed to help you improve your financial management, often leading users to discover money-saving opportunities they hadn't considered. "I love how I can see everything in one place," remarked one reviewer, "it makes me feel so much more in control."

Transaction Mastery: Tracking and Categorization That Works

A core strength that translates directly into positive real-world experiences is Rocket Money's transaction management. The app automatically imports and categorizes transactions from all connected accounts. This seemingly simple feature is a game-changer for many. No more manual data entry or guesswork.

Users can easily mark items as recurring, split transactions, or categorize them as tax-deductible. More advanced users appreciate the ability to create custom rules for specific vendors, ensuring that future transactions are always categorized correctly. This level of automation and customization empowers users to get a granular view of where their money is going without endless manual effort. It’s fundamental to effective budgeting and a significant time-saver.

Taming the Subscription Beast: Real-World Wins (and Where It Falls Short)

Perhaps the most celebrated feature, and a frequent star in positive reviews, is Rocket Money's ability to identify and assist in canceling recurring subscriptions.

Identifying and Flagging: The Initial Relief

We all have them: those forgotten gym memberships, streaming services we rarely use, or free trials that stealthily transitioned into paid subscriptions. Rocket Money excels here, automatically scanning your transactions to highlight these recurring payments. Users describe a collective gasp of surprise (and sometimes horror) at discovering how many subscriptions they were unknowingly paying for.

"I found three subscriptions I'd completely forgotten about," one user shared, "Rocket Money easily saved me over $50 a month just by pointing them out." This initial discovery phase is often enough for many users to see immediate value.

The Cancellation Process: User Success Rates and Limitations

Once identified, Rocket Money offers assistance in canceling these services. For many common subscriptions, the app can initiate the cancellation process directly or provide clear instructions on how to do it yourself. This convenience is a major draw. However, it’s important to manage expectations: Rocket Money may not be able to cancel every service directly, especially those with complex cancellation policies or obscure billing practices.

While most users report a high success rate, a few note instances where they still had to make a phone call or jump through a few hoops. Still, the overwhelming sentiment is positive, with users expressing relief and gratitude for the guidance. Many users find this a lifesaver when canceling those pesky recurring subscriptions. It's a feature that pays for itself quickly if you have even a couple of overlooked subscriptions.

The Bill Negotiation Gamble: When Rocket Money Fights For You

Beyond subscriptions, Rocket Money steps into another financially sensitive arena: negotiating lower rates on your existing bills. This service offers a compelling promise: pay only if they succeed, and only a percentage of your first-year savings.

How it Works: The "No Win, No Fee" Promise

Rocket Money can attempt to negotiate lower bills with various service providers, including common giants like Comcast (Xfinity), the New York Times, and Verizon. The process typically involves giving Rocket Money authorization to contact the biller on your behalf. If they successfully lower your bill, they charge a percentage (usually 30-40%) of the amount saved in the first year only. If they can't negotiate a better deal, you pay nothing. This risk-free model is highly appealing to users.

User Testimonials: Success Stories vs. the Misses

User experiences here are a mixed bag, but lean heavily towards satisfaction. Many users report significant savings, often hundreds of dollars annually, especially with internet and cable providers. "They saved me $30 a month on my internet bill," exclaimed a happy customer, "it was totally worth the cut they took." These successful negotiations are often highlighted as a standout feature, demonstrating real, tangible financial benefits.

However, not every negotiation is a success. Some users report that Rocket Money couldn't find a better deal for them, or that the savings were minimal. Factors like your current contract terms, customer loyalty, and the specific policies of your service provider can influence the outcome. Still, the general consensus is that it's a valuable service to try, given there's no upfront cost for failure. We've heard many successful bill negotiation stories with Rocket Money, proving its worth for a significant number of users.

Budgeting That Actually Sticks? User Perspectives on Financial Planning

Budgeting is often seen as a chore, but Rocket Money aims to make it more manageable. Its features cater to both beginners and those who want more granular control.

Automatic Budgeting: A Helping Hand or Too Generic?

The app offers automatic budget suggestions based on your past spending. For many users, particularly those new to budgeting, this is an excellent starting point. It takes the guesswork out of assigning initial limits and helps visualize typical spending patterns. "I never knew where to start with budgeting," one user commented, "the automatic suggestions gave me a solid baseline."

However, some users find these suggestions a bit too generic or not perfectly aligned with their financial goals, especially if their spending habits fluctuate or they have unique financial situations. This isn't necessarily a flaw, but rather a point where users need to take the reins.

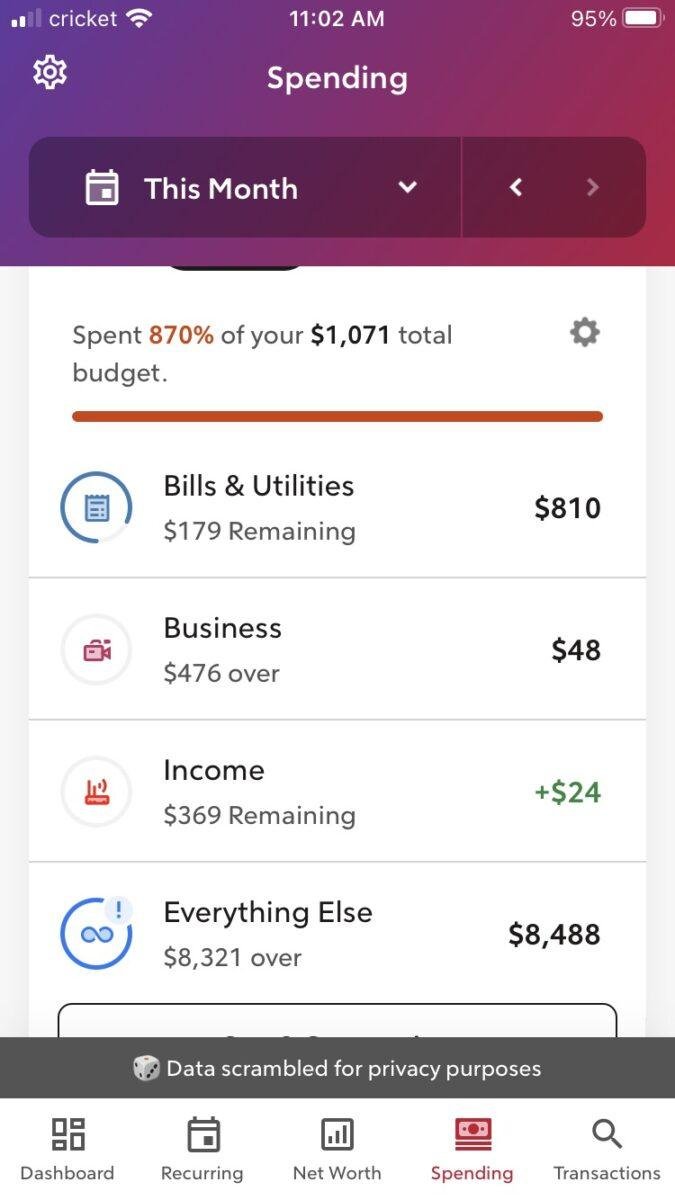

Custom Budgets & Spending Categories: Taking Control

Where Rocket Money truly shines for dedicated budgeters is its flexibility for custom budgets. Users can create individual spending and earning categories, tailoring the budget precisely to their needs. This allows for fine-tuning that moves beyond broad categories to reflect specific financial priorities, whether it's saving for a down payment or cutting back on dining out. For those looking to get serious about their money, diving into Rocket Money's budgeting features can be a game-changer. The ability to create rules for transactions (e.g., all Starbucks purchases go into "Coffee & Treats") further streamlines the process, reinforcing the app's strength in transaction management.

Smart Savings & Financial Goals: Setting Money Aside Without Thinking

Rocket Money also integrates a non-interest-bearing savings account called "Rocket Money Financial Goals," offered through NBKC Bank (FDIC-insured). This feature is designed to help users automate their savings.

"Smart Savings" in Action

The "Smart Savings" option is a popular choice, allowing the app to automatically transfer small amounts to your savings goal based on your spending habits and account balances. Users appreciate this "autopilot" approach, as it helps them build savings without actively thinking about it. "It's amazing how quickly small amounts add up when you don't even notice them leaving your checking account," a user noted.

The "Rocket Money Financial Goals" Account

Users can define specific financial goals—like an emergency fund, a vacation, or a down payment—and then choose between "Smart Savings" for automated deposits or "Custom Savings" for user-defined transfer schedules and amounts. While the account itself doesn't offer interest, its primary value lies in its integration with the budgeting and spending insights, helping users consistently work towards their objectives. It's a tool for disciplined saving, rather than investment growth.

The Premium Question: Is "Pay-What-You-Wish" Worth the Price?

Rocket Money offers a free tier with basic account management and balance alerts, but many of its most powerful features are locked behind its Premium subscription. This is where user opinions sometimes diverge, particularly regarding the "pay-what-you-wish" model.

Free vs. Premium: What You Get (and What You Miss)

The free version provides a good starting point for tracking balances and basic alerts. However, the advanced capabilities—such as detailed budgeting, comprehensive dashboards, subscription cancellation assistance, shared accounts, and credit score breakdowns—all require a Premium account.

Users generally agree that the Premium features significantly enhance the app's utility. The ability to automatically cancel subscriptions and benefit from bill negotiation alone can easily justify the cost for many. "The subscription cancellation feature paid for itself within the first month," a happy Premium user stated.

Understanding the Pricing Confusion

The Premium plan's "pay-what-you-wish" model, with suggested amounts ranging from $6 to $12 per month, is a unique approach. While some users appreciate the flexibility, others find it a bit confusing. They wonder if paying less means receiving fewer features or less support, which isn't the case. The intent is to make the app accessible, but it can lead to uncertainty about the 'fair' price to pay. It's crucial to be clear on understanding the Premium vs. Free tiers before committing.

The 7-Day Trial: User Expectations vs. Reality

Rocket Money offers a 7-day Premium trial, which is excellent for exploring the advanced features. However, users must provide credit card details upon signup. This is a common industry practice but occasionally leads to frustration for those who forget to cancel before the trial ends and are subsequently charged. It’s a minor detail, but one to be aware of to avoid unexpected charges.

Security & Trust: Are Your Finances Safe with Rocket Money?

When it comes to personal finance apps, security is paramount. Rocket Money addresses these concerns with several robust measures.

Plaid Integration and Encryption

Rocket Money connects to your financial accounts using Plaid, a widely used and respected platform that acts as a secure intermediary between your bank and third-party apps. This means Rocket Money itself doesn't store your online banking credentials on its servers.

Furthermore, the app employs bank-level 256-bit encryption for all data, a standard in financial security. Users consistently express confidence in these measures. "I wouldn't link my accounts if I didn't trust their security," one user affirmed, highlighting the importance of this aspect.

Multi-Factor Authentication

Adding another layer of protection, Rocket Money offers multi-factor authentication (MFA). This requires users to verify their identity through a second method (like a code sent to their phone) in addition to their password, significantly reducing the risk of unauthorized access. Many users prioritize Rocket Money's robust security measures when choosing a financial management tool. This commitment to security is a major factor in the app's overall positive reputation for trustworthiness among its user base.

Where Rocket Money Still Has Room to Grow (User Feedback)

While user reviews largely paint a positive picture, there are areas where Rocket Money could evolve, particularly for users with more complex financial needs.

Investment Management: The Common Critique

As noted earlier, Rocket Money's investment management capabilities are minimal. Users with significant investment portfolios or those looking for detailed analytics, performance tracking, or robo-advisory services often find this aspect lacking. They typically need to supplement Rocket Money with a dedicated investment app or platform. This isn't necessarily a flaw if your primary goal is budgeting and savings, but it's a common point of feedback for those seeking an all-in-one financial solution.

Beyond the Core: Features Users Wish For

Some users express a desire for more advanced customization options in budgeting, such as support for more complex budget methodologies (e.g., zero-based budgeting directly within the app rather than through custom categories). Others occasionally wish for more integrated financial planning tools beyond simple goal setting, like retirement planning calculators or tax optimization features. These are often "nice-to-have" additions rather than critical gaps, but they reflect a user base that appreciates the app's core strengths and hopes to see it grow further.

The Verdict: Who Benefits Most from Rocket Money's Real-World Experience?

So, after dissecting the myriad of user reviews and real-world experiences, who stands to gain the most from Rocket Money?

If you're someone who feels overwhelmed by tracking multiple accounts, is constantly surprised by recurring charges, or struggles to consistently save, Rocket Money is likely to be a game-changer for you. Its intuitive interface, robust transaction management, and highly effective subscription cancellation and bill negotiation features offer tangible, immediate value. The peace of mind that comes from having a clear overview of your finances and the automated savings can be truly transformative.

However, if you're already a meticulous budgeter, have a complex investment portfolio you wish to manage within a single app, or are comfortable negotiating your own bills, you might find some of Rocket Money's key strengths less impactful. The Premium tier offers significant value, but it's essential to weigh the cost against the specific features you'll actively use.

Ultimately, Rocket Money excels at helping you gain control over your everyday spending, identify hidden leaks in your budget, and automate the tedious aspects of financial management. It's a powerful ally for anyone looking to simplify their financial life and build healthier money habits. Consider what you truly need from a finance app, take advantage of the trial (with a reminder to cancel if it's not a fit), and see if Rocket Money can launch your finances to new heights.